President Franklin Delano Roosevelt attempted to increase government revenue in the 1930s and 40s. He instituted a 100% income tax on all income over $25,000 in 1942. Sadly, this information is hard to find. Even harder to find is the number of Americans who filed for taxable incomes over $25,000 dollars that year: 0. People don't like taxes. As a result, higher taxes just cause more people to try to evade them. This is the origin of the Laffer Curve.

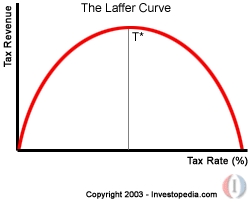

The Laffer Curve

The Laffer Curve tells us that there is a point T that is the highest possible revenue the government can recieve from taxing. When the tax is raised above point T, revenue begins to fall again. Most economists agree that point T is somewhere between 27 and 29%.

Why, then, does the government tax more than 29%? It is simple, they want more money. As much information is out there to prive this point, the government continues to try to sneak higher taxes past the people so that it can get more revenue. Why do I say sneak? It's true. The government has to make the law confusing in this manner because if people know what they are being taxed, they will not pay. This is proven by the Laffer Curve which politicians know all too well.

Still, human beings are found to be overwhelmingly good at protecting their property (note: Property is a Natural Right). The government has yet to slip something past us. The obvious example is that the massive businesses that are being taxed the highest are paying accountants to find every possible tax exemption including moving headquarters overseas.

Conclusive of this information, we find that higher taxes do not equal higher revenue. Next time the government mentions raising taxes on the rich (they're the ones with the money to pay 15 accountants) remember that you will be the one suffering the burden of debt.

Sincerely,

Ted

No comments:

Post a Comment